The U.S. Food and Drug Administration (FDA) doesn’t wait for dangerous drugs to reach pharmacy shelves. It stops them at the border - and it’s getting smarter about it. Since September 2025, the FDA has been using its most aggressive tool yet to block shipments of weight-loss drug ingredients like semaglutide and tirzepatide from manufacturers that don’t meet basic quality standards. This isn’t random. It’s a system called Import Alerts, and it’s changing how global drug supply chains operate overnight.

What Is an FDA Import Alert?

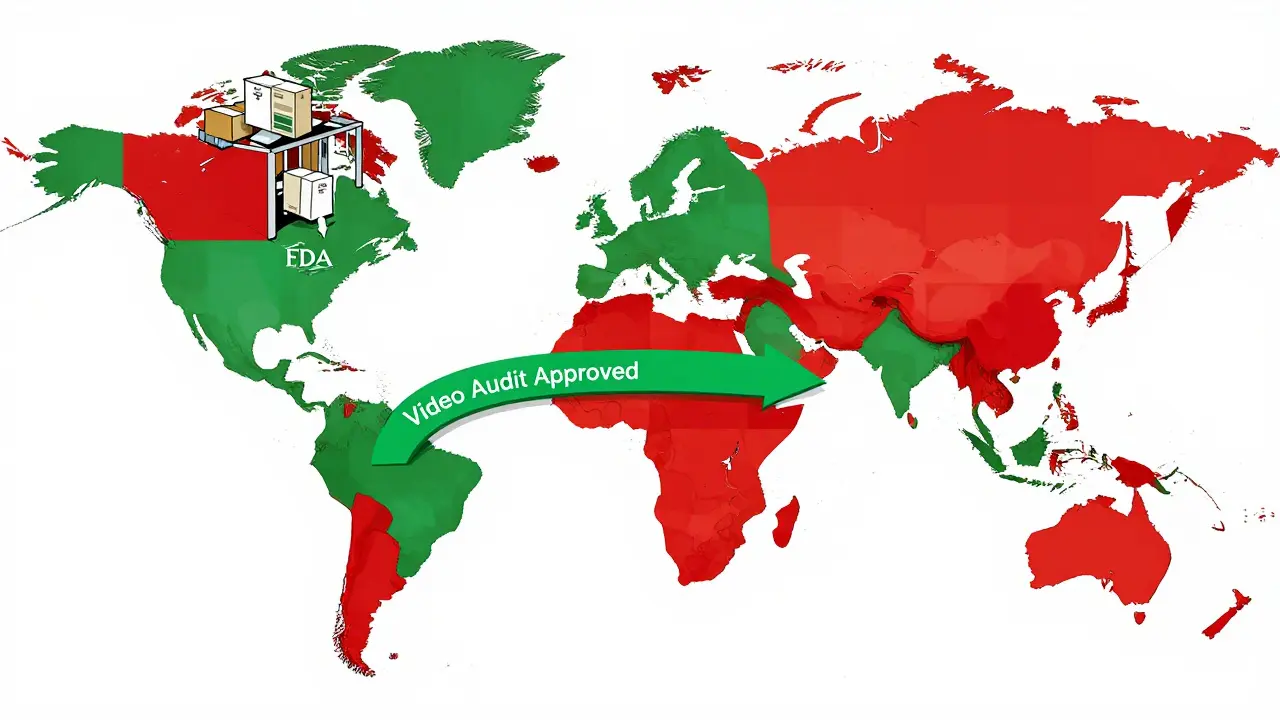

An FDA Import Alert is a public notice that tells U.S. customs officials to automatically detain shipments from specific manufacturers or countries. No inspection needed. No paperwork review. Just stop it. The system was built to catch patterns - not one bad batch, but repeated failures. If a factory has been caught making contaminated pills, falsifying test results, or skipping quality controls multiple times, the FDA flags it. Once flagged, every future shipment gets held at the port. The FDA uses a color-coded system to show risk levels:- Green List: Manufacturers with proven compliance. Their shipments clear quickly - over 99% get released without delay.

- Yellow List: Warning zone. Shipments may be held for review. Companies here are trying to fix problems but haven’t yet proven they’re clean.

- Red List: Blocked. No exceptions. Shipments are detained on sight. These are the factories with repeated violations.

Why GLP-1 Drugs? The Public Health Crisis Behind the Ban

GLP-1 drugs like Ozempic, Wegovy, and Mounjaro have exploded in popularity. In 2024, the global market hit $35.2 billion. But demand outpaced supply. Legitimate manufacturers couldn’t keep up. So, unapproved labs - mostly in India and China - started producing bulk ingredients and shipping them to U.S. compounding pharmacies. These weren’t just unapproved. Many were unsafe. FDA testing showed that 68.4% of seized GLP-1 shipments contained impurities exceeding international safety limits. Some had heavy metals. Others had wrong dosages - a single vial could contain 200% more active ingredient than labeled. Patients were getting sick. Some ended up in the ER. The FDA called it a public health emergency. On September 5, 2025, the agency announced the Green List initiative. Only manufacturers who passed strict audits and submitted full documentation could continue shipping. The rest? Automatic detention. Within weeks, 98.7% of non-Green List shipments were refused. That’s not a mistake. That’s the system working.How the System Works: From Port to Penalty

When a shipment arrives at a U.S. port - whether it’s Los Angeles, New York, or Houston - it’s scanned into the Automated Commercial Environment (ACE) system. If the manufacturer is on the Red List, the system flags it instantly. Customs holds the goods. The importer gets a notice: “Your shipment is refused.” Now comes the hard part. To get the drugs released, the importer must prove the product is safe. That means:- A Certificate of Analysis (CoA) from an FDA-recognized lab - not just any lab.

- Third-party audit reports showing the facility follows current Good Manufacturing Practices (cGMP).

- Proof of raw material traceability - all the way back to the chemical supplier.

- Stability testing under three conditions: refrigerated, room temperature, and high heat/humidity.

Who’s Getting Hit the Hardest?

The crackdown isn’t random. Of the 89 facilities affected by the GLP-1 Import Alert, 73 are in India. Nine are in China. Seven are in Europe. Why India? Because it’s the world’s largest supplier of generic APIs. Many of these factories built their business on low-cost, high-volume production - often cutting corners on documentation, testing, and audits. The Indian Pharmaceutical Alliance estimates 28,500 jobs are now at risk. Some factories are shutting down. Others are scrambling to hire FDA consultants and pay $50,000 for third-party audits. One company spent $420,000 installing a blockchain traceability system just to meet new batch-level requirements. But it’s not just the manufacturers. U.S. pharmacies that relied on cheap compounded GLP-1 drugs are now seeing prices jump 14.3%. Patients are paying more. Some are going without. The FDA says that’s the cost of safety.The Green List: A Lifeline - But Not an Easy One

Getting on the Green List isn’t a formality. It takes 137 hours of work on average. Companies need:- A full FDA inspection - at least five days on-site.

- Three consecutive shipments that pass inspection without issue.

- Executive certification signed by the plant manager, vowing full compliance.

- Video evidence of corrective actions - yes, video. The FDA now accepts video proof of equipment cleaning, testing procedures, and staff training. Companies that include video have an 87.4% approval rate. Those that just submit papers? 42.1%.

What’s Next? The Ripple Effect

The GLP-1 Import Alert is just the beginning. FDA Commissioner Dr. Robert Califf said in November 2025 that the same system will expand to all high-risk biologics - starting with monoclonal antibodies in Q1 2026. That means cancer drugs, autoimmune treatments, and gene therapies could soon face the same scrutiny. Other countries are watching. The European Medicines Agency (EMA) announced in November 2025 it will adopt similar API screening by mid-2026. China’s NMPA is now requiring all API exporters to meet FDA-equivalent standards starting January 1, 2026. The global supply chain is being rewired. Meanwhile, big players are buying up capacity. Catalent spent $980 million to acquire Novasep’s peptide business - a direct move to secure FDA-compliant GLP-1 production. Generic manufacturers like Viatris reported a $417 million revenue hit in Q3 2025. Smaller companies? Many are folding.Is the System Fair?

Critics say the FDA is too harsh. A lawsuit filed in November 2025 by four Indian pharmaceutical associations claims the Green List is an illegal trade barrier under WTO rules. Some experts warn that the speed of enforcement is creating artificial shortages - pushing desperate patients toward even riskier gray-market suppliers. But the data doesn’t lie. The FDA’s system caught 22.1% of refused shipments that met pharmacopeial standards but failed documentation. That’s not a safety issue - it’s a compliance failure. And in pharma, paperwork isn’t bureaucracy. It’s proof. The FDA isn’t trying to punish foreign manufacturers. It’s trying to protect patients. If you can’t prove your drug is safe, you don’t get to sell it here. Period.What Should Importers Do Now?

If you’re importing pharmaceuticals into the U.S., here’s what you need to do:- Check the FDA’s Import Alert list - every week. It updates daily.

- Verify your supplier is on the Green List - not just “certified.”

- Require CoAs from FDA-recognized labs only. Don’t accept generic reports.

- Start documenting your supply chain to Tier 3 suppliers - every chemical, every solvent.

- Plan for audits. Budget $45,000-$68,000 for a third-party audit.

- Record video of your quality processes. The FDA is watching.

What happens if a drug shipment is detained by the FDA?

If a shipment is detained, the importer receives a notice from U.S. Customs and Border Protection. To release the goods, they must submit corrective documentation - including FDA-recognized Certificates of Analysis, third-party audit reports, and proof of compliance with current Good Manufacturing Practices. If the shipment isn’t cleared within 90 days, it must be destroyed or exported under FDA supervision. Failing to comply can result in penalties up to three times the value of the goods.

How can a manufacturer get off the FDA’s Red List?

To get removed from an Import Alert Red List, a manufacturer must complete four steps: undergo a full FDA inspection, submit a root cause analysis with a corrective action plan (CAPA), prove three consecutive shipments meet all compliance standards, and obtain executive certification of compliance. The average time to removal is 11.7 months. Companies that include video evidence of corrections have an 87.4% approval rate on their petitions.

What is the FDA Green List, and why does it matter?

The FDA Green List identifies manufacturers with proven compliance history who are exempt from automatic detention. Shipments from Green List suppliers are cleared rapidly - over 99% pass without inspection. For importers, working with Green List suppliers reduces delays, avoids penalties, and ensures consistent supply. For manufacturers, getting on the list requires rigorous audits, documentation, and proof of quality control - but it’s the only way to reliably access the U.S. market.

Are all foreign drug manufacturers affected by Import Alerts?

No. Import Alerts target specific manufacturers with a history of violations - not entire countries. However, certain countries have higher concentrations of flagged facilities. For example, 82% of the 89 facilities affected by the GLP-1 Import Alert are in India. Manufacturers in countries with strong regulatory oversight, like the U.S., EU, or Japan, are less likely to be flagged unless they have specific compliance issues.

Can a company appeal an Import Alert decision?

Yes, companies can petition for removal from an Import Alert by submitting detailed documentation and evidence of corrective actions. However, the FDA does not offer a formal appeals process. Instead, companies must demonstrate full compliance through inspections, testing, and verified shipments. Legal challenges can be filed in U.S. courts, as seen in the November 2025 lawsuit by Indian pharmaceutical associations, but these rarely result in immediate changes to enforcement.

How does the FDA’s system compare to other countries?

The FDA uses a risk-based automatic detention system (DWPE), which stops shipments from flagged manufacturers without physical inspection. The European Medicines Agency (EMA) relies on random sampling of 10-15% of high-risk shipments. China’s NMPA uses a single blacklist with no graduated compliance tiers. The FDA’s system is faster for compliant suppliers but has higher false-positive rates. However, it’s more effective at blocking unsafe products before they enter the U.S. supply chain.

Katherine Blumhardt

December 25, 2025 AT 00:29Oluwatosin Ayodele

December 25, 2025 AT 01:04Gary Hartung

December 25, 2025 AT 22:04Mussin Machhour

December 26, 2025 AT 20:58Carlos Narvaez

December 27, 2025 AT 17:03Michael Dillon

December 27, 2025 AT 23:01Linda B.

December 29, 2025 AT 19:02Sophie Stallkind

December 31, 2025 AT 05:07Bailey Adkison

January 1, 2026 AT 17:38Jason Jasper

January 2, 2026 AT 19:09